Income Tax Services Green From Akron Income Tax Co

Dealing with taxes can be stressful and daunting, especially if you’re unfamiliar with the process. Therefore, with years of experience, our Akron Income Tax Co team can help with all your income tax services in Green, Ohio and the surrounding areas, including help with earned income tax credit. Whether you’re an individual or a small business owner, our team of experts can help you navigate the complexities of the tax code and ensure that you get the most favorable outcome possible for the tax year.

Also, we pride ourselves on our customer service. We know that dealing with taxes and taxation can be stressful, so we go out of our way to ensure our clients are comfortable and informed throughout the process. We offer a free initial consultation to discuss your unique situation, and we’re always available to answer any questions you may have about residency, international tax, and tax consequences in the USA. Check out our Green Tax Video

Our Expert Preparation for Income Tax Services Green Ohio

With our years of experience, we are here to help with all your income prep needs with income tax services Green. We offer a wide range of services to individuals, small businesses, and organizations throughout the Greater Akron area.

Also, we prepare our clients’ federal, state, and local income tax returns. We also offer consulting services on a variety of tax-related issues.

Tax Planning

With our knowledge of the ever-changing tax laws, we can help you plan for your future and maximize your deductions. You can confidently handle your taxes by up-to-date professionals on the latest tax laws. Also, we can help you plan for retirement and other financial goals.

Tax Preparation

We prepare taxes for individuals, businesses, and organizations. We take the time to get to know our clients and their unique tax situations. This allows us to maximize their deductions and minimize their tax liability. We also offer free e-filing, which allows you to get your refund faster.

Tax Resolution

If you have difficulties paying your taxes or are facing an audit, we can help. We will work with you and the IRS to find a resolution in your best interests. We have experience dealing with various tax-related issues and can help you resolve your problems.

Small Business Consulting

We offer a variety of services to small businesses, including start-ups. We can help you with bookkeeping, payroll, and tax preparation. Also, we will work with you to ensure that your business complies with all the necessary regulations.

Nonprofit Organizations

We have experience working with nonprofit organizations. Also, we can help you with tax exemption applications, 990 forms, and other compliance issues. Moreover, we will work with you to ensure your organization meets its tax-exempt status requirements.

Estate Planning

We can help you plan for the future of your estate. We will also work with you to create a plan that minimizes taxes and maximizes assets for your heirs. For example, we can help you create a trust or set up a charitable giving plan.

Retirement Planning

We offer a variety of services to help you plan for retirement. Furthermore, we can help you with 401(k) and IRA rollovers, pension distributions, and Social Security planning. Also, will work with you to create a plan that meets your unique needs and goals.

Financial Planning

In the case of financial planning, we can help you with budgeting, investment planning, and debt management. Also, we offer services to help you plan for major life events, such as buying a home or sending your children to college. We also offer accounting services, including monthly reconciliation, and deal with unemployment compensation, capital gains, and refund transfer at a reasonable cost.

Tax Audit Representation

If the IRS is auditing you, we can help. We will review your case and represent you during the audit process. We will work with you to ensure that the audit is conducted fairly and efficiently.

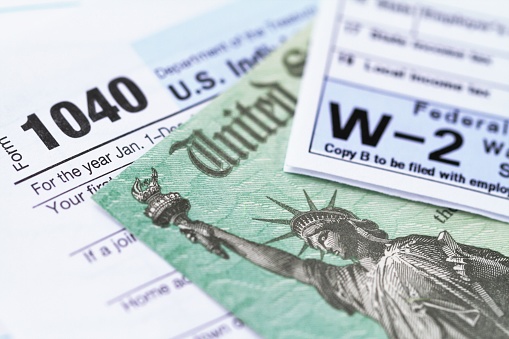

Which Forms Can We Help With?

We can help you with a wide range of tax forms, including:

- 1040: It’s the most basic form for people with simple tax situations. You use this form to report your income, deductions, and credits.

- 1040A: This is a shorter version of 1040. It’s used by people with simple tax situations who don’t itemize their deductions.

- 1099: This form reports income from sources other than wages, salaries, and tips. For example, you would use this form to report interest or dividend income.

- 1020 Corporate: This form is used by corporations to report their income, deductions, and credits.

- W-2: This form is used by employers to report wages, salaries, and tips paid to their employees.

- 1099-MISC: Use this form to report miscellaneous income, such as royalties or rents.

- 1065 Partnership: Partnerships organizations use it to report their income, deductions, and credits.

- 1120-S S-Corporation: This form is used by S-corporations to report their income, deductions, and credits.

- Schedule C (Form 1040): This form is used by sole proprietors to report their business income or loss.

- 990: The form is used by tax-exempt organizations to report their finances.

- 941 Employer’s Quarterly Federal Tax Return: Employers use it to report their federal taxes.

These are just some of the forms we can help you with income tax services Green. If you have any questions about which form to use, we can help. Additionally, we will make sure you use the right form for your situation.

Why Choose Us for income tax services Green Ohio?

At Akron Income Tax Co, we provide comprehensive income tax services to individuals and businesses in Green, Ohio. We have years of experience preparing taxes, and our staff comprises certified public accountants (CPAs) and enrolled agents (EAs). We’re providing the highest level of service possible, and we stand out due to:

- Affordable Pricing: You shouldn’t have to break the bank to get quality tax services. That’s why we offer competitive pricing on all of our services.

- Accuracy: We’re committed to getting your taxes done right and guaranteeing accuracy. If we make a mistake, we’ll fix it at no additional cost to you.

- Convenience: We know that your time is valuable. That’s why we offer convenient online scheduling and extended hours during tax season.

- Personalized Service: No two taxpayers are exactly alike, and we understand that. We take the time to get to know you and your unique situation to provide personalized service, and a tax professional will deal with your taxes.

- Maximum Tax Refund: To get the most out of your tax return, you need a qualified tax preparer. We’ll make sure you get the maximum refund possible.

If you’re looking for quality income tax services in Green, Ohio, look no further than Akron Income Tax Co. Contact us today to schedule a consultation.

How To Get your Refund Started?

To get started with our income tax services, you need to:

- Schedule A Consultation: We offer free consultations to all new clients. During the consultation, we will discuss your tax situation and determine how we can help you.

- Provide Your Tax Documents: Once you’ve scheduled a consultation, you must gather your tax documents and bring them to the meeting. This will help us determine what services you need.

- Sign A Service Agreement: If we decide to work together, we will sign a service agreement that outlines our services and fees.

- Pay Your Invoice: After we have prepared your taxes, we will send you an invoice for our services. You can pay this online or in person.

Once you have completed these steps, we will get to work on your taxes. We’ll ensure everything is done accurately and efficiently so you can get your refund as soon as possible.

What to Bring for Tax Appointment?

Tax season can be a stressful time for many people. It’s important to be prepared with the necessary documents when you meet with your tax professional. In this blog, we’ll cover everything you need to know about what to bring for your tax appointment, from basic personal information to essential tax deduction documents. We’ll also discuss the importance of accurate and complete documentation in tax filing and how it impacts your tax returns. Additionally, we’ll provide a detailed overview of income statements and adjustments to your income that may affect your taxes. By the end of this post, you’ll have all the information you need to make sure your tax appointment goes smoothly and efficiently.

Understanding the Importance of Tax Preparation

Accurate tax preparation ensures adherence to tax laws and maximizes refunds while minimizing liabilities. It also helps individuals and businesses avoid penalties and audits. Staying updated on tax laws is crucial, and professional tax preparation services can assist with complex situations. Using a tax calculator can be a good idea for maximizing refunds. Staying organized with a checklist and keeping records of medical bills, gross income, and other tax-related documents is essential for tax time.

The Role of Accurate and Complete Documents in Tax Filing

Accurate and exhaustive records play a crucial role in the smooth filing of tax returns. Well-organized documentation simplifies the entire tax filing process, ensuring that no errors or delays occur. It is essential to understand that incomplete or inaccurate documentation can result in filing errors and unwanted delays. Furthermore, maintaining comprehensive records of income, expenses, and investments is pivotal in supporting various tax deductions and credits, ultimately leading to a maximized refund and minimized tax liability.

Impact of Incomplete or Incorrect Documentation on Tax Returns

Incomplete or inaccurate documentation can lead to errors in tax filings, potentially affecting tax refund amounts and triggering audits. The completeness and accuracy of documentation are crucial for ensuring the precision of tax returns. Improper documentation may result in discrepancies and impact an individual’s tax liability. Therefore, it is essential to pay close attention to gathering and organizing all necessary documents to avoid any filing inaccuracies. Additionally, maintaining proper documentation throughout the tax year is a good idea to ensure a smooth and accurate filing process.

Basic Personal Information Required for Tax Appointment

Providing accurate personal details is crucial for tax appointments, including social security numbers, address, and contact information. Filing status and dependent details greatly influence tax appointment requirements and facilitate seamless tax processes. NLP terms: driver’s license, tax year, individual taxpayer identification number.

Social Security Details and their Importance

Social security numbers play a vital role in tax identification and reporting, impacting tax benefits, credits, and deductions. It’s crucial to provide accurate dependents’ social security numbers for tax appointment documentation. Incorrect social security information can lead to tax filing complications, affecting the verification process and potentially triggering audits. Ensuring accurate social security details is essential for tax filing accuracy, maximizing refunds, and minimizing issues with the IRS. Verification and inclusion of social security details are integral to a successful tax appointment.

The Relevance of Personal Identification Numbers

When preparing for tax time, having accurate personal identification numbers is critical. For individuals not eligible for social security numbers, obtaining an individual taxpayer identification number (ITIN) is essential. It ensures proper documentation and compliance with tax regulations, preventing errors in tax filing. ITINs play a significant role in accurately reporting gross income, which subsequently affects the calculation of taxes owed or the maximum refund available. Understanding the relevance of these identification numbers is a good idea for smooth tax time processes.

Types of Income Statements to Bring to Your Tax Appointment

When visiting your tax preparer, be sure to bring various income statements essential for accurate filing. W-2 forms detail wages, salaries, and tips, while 1099 forms report interest, dividends, and self-employment earnings. Additional K-1 forms provide business income, credits, and deductions. Understanding these statements ensures comprehensive tax reporting, leading to an accurate assessment. Bringing all relevant income statements, including driver’s license and Social Security numbers, is crucial for maximizing your tax refund and complying with tax regulations. Ensure you have all necessary documentation for a smooth tax time experience.

Detailed Overview of W-2 and 1099 Forms

W-2 forms provide a detailed breakdown of income earned while working as an employee, showcasing tax withholdings and other relevant financial information. On the other hand, 1099 forms encapsulate income from diverse sources, including freelance work, investments, and rentals. Both W-2 and 1099 forms play a critical role in accurately reporting income to the IRS, impacting tax refund calculations. Understanding the intricacies within W-2 and 1099 forms is essential for comprehensive tax filing and assessment.

Information on Other Relevant Income Reports

When preparing for your tax appointment, you should gather additional income reports such as brokerage statements to provide details of investment income. Rental income documentation, including property income and expenses, is essential for tax reporting. Moreover, interest and dividend income statements significantly contribute to comprehensive tax filing. It’s important to understand that capital gains and losses documentation directly influences your tax obligations and benefits. Getting a good idea about these various income reports will ensure thorough and accurate tax filing and assessment.

Essential Tax Deduction Documents for your Accountant

When preparing for your tax appointment, ensuring you have the necessary support for your tax deduction claims is imperative. Documentation for charitable donations, property tax bills, mortgage interest statements, medical expenses, and business expenses all play a crucial role in maximizing tax-saving opportunities. Understanding and gathering these essential tax deduction documents will enable you to claim deductions accurately, leading to potential tax savings. It’s always a good idea to familiarize yourself with the specific NLP terms related to your tax year and individual taxpayer identification number.

The Importance of Keeping Receipts for Expenses

When managing expenses, keeping receipts is crucial to validate tax deductions and substantiate deductible items. Accurate record-keeping ensures proper documentation for tax-deductible expenses, supporting tax return filing and ensuring accurate reporting. Receipts are essential for proving the basis of expenses and can contribute to maximizing refunds. For individual taxpayer identification number verification, receipts play a vital role in substantiating expenses. Overall, maintaining receipts for expenses is a good idea for ensuring accurate tax reporting and maximizing deductions.

Details on Other Necessary Tax Deduction Documents

When getting ready for your tax appointment, it’s essential to gather all the necessary documents for tax deductions. This includes charitable donation receipts, records of medical expenses, property tax payment receipts, documentation for home office expenses, and records of health insurance payments. Ensuring you have all these documents in place can maximize your tax-saving opportunities and help you claim the deductions you’re eligible for. It’s a good idea to keep a checklist to make sure you don’t miss any crucial tax deduction documents.

Adjustments to Your Income and Related Documents

When preparing for your tax appointment, it’s crucial to gather adjustment documents for expenses like tuition or healthcare. For income adjustments, receipts for childcare expenses and IRA contributions are essential. Additionally, don’t forget documentation for student loan interest payments and capital gains or losses. These necessary income adjustment documents play a significant role in ensuring accurate tax reporting and could potentially lead to a max refund. It’s a good idea to have these documents ready to provide your CPA with the necessary information for a smooth tax time experience.

Understanding Tax Deductions and Credits

When it comes to understanding tax deductions and credits, proper documentation is vital for successful deduction claims. This includes keeping receipts for business expenses and tax payments, as well as documentation for tax refund claims. Moreover, maintaining records for tax credit claims is crucial to comprehend the intricacies of tax deductions and credits. By organizing your documentation effectively, you can maximize your tax refund and ensure compliance with tax regulations. Utilizing a tax calculator can also be a good idea to estimate your deductions and ultimately secure a max refund.

Records of IRS Taxes Already Paid and Their Significance

Maintaining a record of taxes already paid, such as tax bill receipts, plays a crucial role in tax return filing. These records, like property tax receipts, are significant for claiming tax credits and deductions. Additionally, they support the accurate filing of taxes and provide vital documentation for assessing one’s tax situation. Ensuring the availability of these records helps in maximizing the refund and minimizing tax liabilities. Keeping track of tax payment receipts is especially important for individual taxpayer identification numbers and supports the use of tax calculators for accurate filings. We are your best choice for Income Tax Services Green Ohio.

Additional Documents to Consider for Your Tax Appointment

When preparing for your tax appointment, it’s beneficial to consider additional documents from the past tax year. This includes last year’s tax return, which provides a basis for this year’s filing and helps in assessing any changes in your financial situation. Gathering documentation for any tax advice received in the prior year is also important, along with records of any income from multiple sources. Additionally, bringing along your social security number and documentation for tax preparer fees can be crucial at tax time. Consider adding these to your checklist for a smooth tax appointment.

FAQs

What are income tax services and why would I need them?

Income tax services Green are professional services provided by tax experts to assist individuals and businesses in preparing and filing their tax returns. These services can help ensure that tax obligations are met accurately and efficiently, maximizing deductions and minimizing the risk of penalties or audits.

Do I Need a Tax Agency?

It is best to consult with a professional tax preparation services to get the most out of your taxes if you don’t have experience of tax software. At Akron Income Tax Co, we have the experience and expertise to help you get the most out of your return. So, we can help you maximize your deductions and ensure you take advantage of all the tax benefits available to you.

What Are the Benefits of Working with A Tax Agency?

There are many benefits to working with a tax agency like Akron Income Tax Co. We can help you save time and money by ensuring that your taxes, including US taxes, are filed correctly and on time. Our tax professionals can also help you reduce your tax liability and get the most out of your return. In addition, we can provide you with peace of mind by handling all the paperwork and details involved in filing your taxes, including the streamlined tax process for catching up on your US taxes using the IRS Tax Amnesty program. With our services, you can have monthly reconciliation delivered to your inbox, ensuring that you stay organized and up-to-date with your financial records.

What Should I Bring to My Tax Appointment?

When you come to Akron Income Tax Co for your tax appointment, there are a few things you should bring with you. First, you will need to bring any documents or records that pertain to your taxable income and deductions. This includes W-2 forms, 1099 forms, bank statements, and receipts for charitable donations. You should also bring your Social Security card and a copy of your prior-year tax return. Lastly, if you have any questions or concerns about your taxes, be sure to note them so we can address them.

How Much Is the Income Tax Preparation Fees?

Indeed, the cost of using a tax agency varies depending on the services you need and the complexity of your taxes. However, at Akron Income Tax Co, we offer affordable rates and payment plans to make our services accessible to everyone starting at $130 for most returns. We also offer a free consultation for income tax services Green, Ohio so you can learn more about our services and how we can help you save money on your taxes.

Read More