How to setup and use Petty Cash

Proper Petty Cash Routine: A Complete Guide to Managing Small Business Expenses

Having a proper petty cash routine is just a small part of a business’s income tax recordkeeping. Businesses should have their checking account, debt and credit cards for proper income and expense tracking and spending cash for business expenses should be your last choice. Moreover, keeping original receipts and paying with a trackable payment method is your best defense to being able to justify your business expenses.

This article will explore the components of a proper routine, including its setup, management, reconciliation, and best practices for safeguarding the fund. By implementing these guidelines, businesses can streamline their operations and minimize risks.

What Is Petty Cash?

Petty cash, also known as a petty cash fund, is a small amount of money that businesses keep on hand to handle minor or incidental expenses, making it ideal for small purchases. The amount of petty cash is a convenient way to cover small costs without relying on a credit card or writing a check.

Typically, the amount of maintained ranges from $50 to $500, though this can vary depending on the country, region, or specific business needs. Therefore, determining the appropriate amount for your company depends on the frequency and nature of small expenses.

Common uses of petty cash include:

- Purchasing small office supplies.

- Reimbursing employees for minor expenses.

- Paying for a catered lunch for clients or small employee groups.

- Covering costs for farewell parties.

- Sending flowers or cards to employees or clients.

- Stocking snacks, tea, or coffee for employees.

Why Proper Petty Cash Management Is Important?

Effective petty cash management is not just about tracking small expenditures; instead, it is an integral part of effective expense management in maintaining accurate income tax records and ensuring financial accuracy. Mismanagement can lead to discrepancies in your financial reports, complicate tax filings, and potentially result in penalties during audits.

Here are key reasons why managing petty cash effectively is important:

- Ensures Accurate Recordkeeping: Proper management provides a clear paper trail for auditors and tax authorities.

- Prevents Misuse: Establishing clear guidelines minimizes the risk of unauthorized spending.

- Streamlines Accounting: Keeping petty cash records up-to-date ensures seamless integration into your overall accounting system.

What are the Two Types of Petty Cash?

1) Imprest Petty Cash Management System: The imprest system maintains a robust internal control by keeping a fixed amount of money in the fund at all times. For example, the petty cash custodian restores the fund to $100 whenever the balance drops below that amount, such as when it reaches $20. This method promotes accountability and simplifies expense tracking, often funded by the company’s checking account.

1) Imprest Petty Cash Management System: The imprest system maintains a robust internal control by keeping a fixed amount of money in the fund at all times. For example, the petty cash custodian restores the fund to $100 whenever the balance drops below that amount, such as when it reaches $20. This method promotes accountability and simplifies expense tracking, often funded by the company’s checking account.

2) Columnar or Analytical Petty Cash System: The columnar or analytical petty cash system categorizes transactions into specific columns based on general ledger codes, such as “office supplies,” “refreshments,” or “meals.” The custodian records each expense under the relevant column and provides a brief explanation of its purpose. This approach improves tracking and ensures precise expense analysis.

What Are Proper Procedures?

When creating and managing a petty cash fund, it is crucial to follow three basic procedures. These steps help ensure the funds remain secure and well-documented.

1. Appoint a Custodian

In small businesses, the owner often manages the fund. However, larger organizations typically delegate this responsibility to a middle-management employee.

The custodian’s duties include:

- Enforcing rules and regulations.

- Overseeing the fund.

- Requesting fund replenishments.

- Distributing funds for approved expenses.

2. Record All Transactions

Next, it’s essential to maintain accurate records of all transactions through journal entries, as with any other financial activity. The most effective way to track expenses is by collecting cash register receipts and other receipts. These receipts should align with the amounts replenished during each accounting period.

The most effective way to track petty cash reconciliation expenses is by collecting detailed vendor petty cash receipts. These receipts should align with the amounts replenished during each accounting period. Regular periodic reconciliations of any discrepancies between the receipts and replenishments must be identified and resolved promptly.

3. Reconcile the Petty Cash Fund

Regularly reconciling the fund is crucial to ensure all expenditures are accurately tracked and reimbursed. Investigate any discrepancies immediately to maintain accuracy and prevent misuse of funds.

By following these procedures, businesses can effectively manage their petty cash and maintain financial transparency.

Best Practices for Managing Petty Cash

Managing petty cash effectively is crucial for maintaining financial control within an organization. Here are some best practices for managing petty cash:

1) Use Petty Cash Sparingly

Petty cash is best reserved for minor, incidental expenses for small companies. Whenever possible, use checks, debit, or credit cards for business transactions. These payment methods are easier to track and provide a clear paper trail.

2) Deposit All Income into the Business Bank Account

All sales or incoming funds, including new funds, should be deposited into the business’s checking account rather than being added directly to the petty cash fund. This ensures accurate income tracking and compliance with financial regulations.

3) Perform Regular Audits

Periodic audits of the petty cash fund are essential for maintaining accuracy and preventing misuse. Audits should include:

- Verifying that the cash on hand matches the balance in the log.

- Ensuring all receipts are present and accounted for.

- Identifying any discrepancies and addressing them promptly.

Regular audits help detect errors and improve overall financial management.

4) Limit Access to Petty Cash

Restricting access to the fund minimizes the risk of theft or misuse. Only the custodian and a designated backup should have access to the fund.

Best Policies: What to Include

A robust policy ensures consistency and reduces the risk of misuse. Here are key elements to include:

- Purpose of Petty Cash: Define what types of expenses qualify for fund usage.

- Transaction Limits: Set a maximum amount for individual transactions (e.g., $50).

- Approval Process: Specify who must approve expenses exceeding a certain threshold.

- Reimbursement Procedure: Detail how employees can request petty cash for authorized purchases.

- Security Measures: Outline how the fund will be stored and protected.

Common Mistakes to Avoid

Even with a structured routine, businesses can fall into common traps. Here’s what to watch out for:

- Lack of Receipts: Missing receipts make it challenging to justify expenses during audits and always insist on proper documentation.

- Mixing Personal and Business Funds: Keep petty cash strictly for business use to avoid confusion and maintain clear records.

- Neglecting Reconciliation: Failing to reconcile the fund regularly can lead to errors or undetected theft.

- Overusing Cash: Using cash for larger transactions increases the risk of financial mismanagement. Stick to checks or cards for substantial expenses.

Benefits of a Proper Petty Cash Routine

Adopting a proper petty cash routine offers numerous advantages, including the following:

- Enhanced Financial Transparency: Clear records not only help stakeholders understand how funds are used but also ensure accountability.

- Streamlined Operations: Additionally, a petty cash fund allows quick payment for minor expenses, which saves both time and effort.

- Reduced Tax Risks: Moreover, detailed documentation minimizes the risk of disputes with tax authorities, making tax processes smoother.

- Improved Cash Flow Management: By tracking petty cash expenses, businesses gain a better understanding of their day-to-day cash flow, which can further enhance overall financial planning.

By following a proper routine, organizations can ensure efficiency, transparency, and better financial control.

Tax Implications of Petty Cash

Petty cash transactions must be included in your business’s income and expense reports. Failure to properly account for these expenditures can lead to complications during tax filings. Here are tips for staying tax-compliant:

- Track All Expenses: Every petty cash transaction should be backed by a receipt and logged accurately.

- Use this fund for Business Only: Personal expenses should never be paid from this fund.

- Include Petty Cash in Financial Statements: Ensure that all petty cash expenditures are reflected in your income and expense reports.

When to Avoid Using Petty Cash

Although petty cash is a convenient tool, there are scenarios where it should not be used:

- For Large Purchases: Expenses that exceed your petty cash limit should be paid through other methods.

- Recurring Payments: Regular payments, such as utility bills or subscriptions, should be handled via check or credit card for better tracking.

- When Digital Payments Are Available: Digital payments provide an instant, trackable record and are generally safer than cash.

Scenario: Petty Cash for Office Supplies

Company: ABC Marketing Agency

Purpose of Fund: To cover small, day-to-day expenses that are too minor to process through the standard accounts payable system.

Setup of Fund:

- The company establishes a petty cash fund of $500.

- The fund is managed by the Office Administrator, who is designated as the custodian.

- The petty cash box and logbook are securely stored in a locked drawer.

Example Use:

1: Purchasing Office Stationery

- The printer ran out of paper. The office administrator uses $25 from the fund to purchase a ream of paper from a local store.

- The administrator collects the receipt and records the transaction in the fund’s logbook: Date: November 29, 2024

- Amount: $25

- Purpose: Office paper purchase

- Remaining Balance: $475

- Date: November 29, 2024

- Amount: $25

- Purpose: Office paper purchase

- Remaining Balance: $475

2: Team Coffee Run

- The team worked late on a project, and coffee was purchased as a gesture of appreciation. The total cost was $40.

- The administrator records: Date: November 30, 2024

- Amount: $40

- Purpose: Team Coffee

- Remaining Balance: $435

- Date: November 30, 2024

- Amount: $40

- Purpose: Team Coffee

- Remaining Balance: $435

3: Shipping Costs

- A small package was mailed to a client, costing $15.

- Recorded as: Date: December 1, 2024

- Amount: $15

- Purpose: Client shipping

- Remaining Balance: $420

- Date: December 1, 2024

- Amount: $15

- Purpose: Client shipping

- Remaining Balance: $420

Replenishment of the Fund:

- At the end of December, the fund balance is reviewed.

- Total expenses recorded are: Office Supplies: $25

- Team Coffee: $40

- Shipping: $15

- Total Spent: $80

- The Office Administrator submits the receipts and logbook to the Accounts Department.

- The fund is replenished by $80 to restore the balance to $500.

- Office Supplies: $25

- Team Coffee: $40

- Shipping: $15

- Total Spent: $80

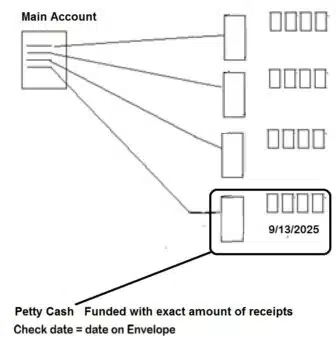

Proper Routine

Start with funding your petty cash fund by writing a new check for $500 ‘Cash’. Use this cash for petty cash items. Every month, more often if you run out, take the receipts and total them up to the exact amount and write another ‘cash’ check for that amount to refill the petty cash. Place the receipts and petty cash slips in an envelope and write the date of the check and the amount on the envelope. Before totaling receipts, cross out any non-deductible items on any receipt, like snacks, drinks, gas (except for mowers), and any other personal items.

Review your accounting procedures and develop an acceptable routine that is auditable to protect your deductible expenses. Using this method should be your least used method of paying for your business expenses. Checks, debt cards and credit cards should be among your 1st choices to pay your business expenses. It is your responsibility to provide receipts for all your expenses in the event you are audited.

Conclusion

Managing this fund is a small but significant part of your business’s financial health. By following these best practices, you can enhance transparency, prevent misuse, and ensure compliance with tax regulations.

For expert assistance with managing your business taxes, bookkeeping, and financial strategies, visit APC1040.com today. Their professional team is ready to help you streamline your finances and achieve peace of mind. Don’t wait—take the first step toward financial clarity now!