Bookkeeping Services in Akron, Oh

Bookkeeping Services for your Small Business

In a small business, accurate books are an essential part of running the business and getting ready to file your Federal Taxes. Can I do my own bookkeeping for my business? A small business can likely do all its own bookkeeping using accounting software, Quicken, QuickBooks or even excel. Many of the operations are automated in the software, making it easy to get accurate debits and credits entered. Self-employment demands the filing of an IRS Federal income tax return at the end of the year.

Bookkeeping is crucial for accurately reporting your income and expenses, as well as generating totals by categories needed for tax filing. On top of that, you need the data used in bookkeeping to file your taxes accurately. In order to file your taxes, the bookkeeper can also prepare a trial balance and close your books. They can provide key financial reports, such as the profit and loss statement and balance sheet, in PDF format.

Guessing is not a viable legal option for the Federal IRS. Whether you want to get a business loan, answer an auditor, or simply design next year’s budget and business plan, you need the assistance of a full-charge bookkeeper. FreshBooks offers 100% compliant tax preparation, taking the stress out of this important but time-consuming process. If you prefer an online bookkeeping service, QuickBooks Live Bookkeeping is a great option to consider.

They connect small businesses with trusted, QuickBooks-certified virtual bookkeepers who can take the lead on your bookkeeping and run essential reports, allowing you to focus on your business. When it comes to bookkeeping services, many companies opt for outsourced bookkeeping to ensure accurate books and efficient financial management.

DIY Bookkeeping

This is an excellent choice for small Businesses when they first start up. It entails the use of a simple internal Bookkeeping Services.

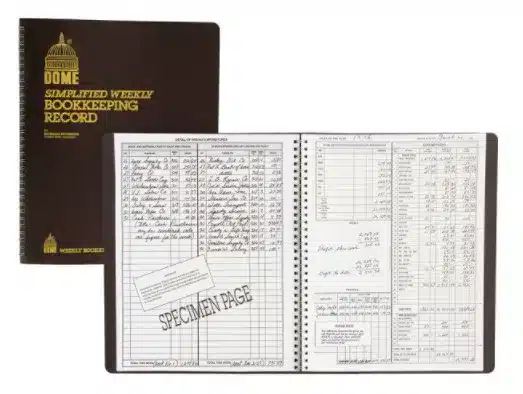

A “Dome Bookkeeping Record” book is the easiest way to track your income and expenses for Taxes. The book is very cheap. You can find it in any office supply store. Another method, instead of using a dome book, is to use our Business report for you to fill out your totals so you can File. The monthly records would be important for your Federal Taxes even when using this book. We would be happy to complete your Federal Taxes each year. Using the book or if you use the Business form. Moreover, keep your monthly records the Federal IRS requires that they are available for inspection. This will ensure easy tracking.

Instead of using a dome book, we can provide a Business report form for you to fill out your totals. The monthly records would be important even when using this book. We would be happy to File your income tax Returns each year when you provide acceptable totals.

Bookkeeping Services Akron Options

As your business grows, it becomes crucial to find the best bookkeeping services to handle all of your bookkeeping needs. At some point, you will need our bookkeeping service to file your returns. Our bookkeeping services start quarterly to save you money. Then, as your business grows, you can transition from a quarterly to a monthly filing routine. The cost is proportional to the amount of records to be handled.

We understand the importance of completing these tasks correctly and in a timely manner, ensuring accuracy and usefulness. In the first month of service, our bookkeeping services ensure you receive an accurate monthly snapshot of your company’s financial picture. The information provided by bookkeepers is a strong indicator of your business’s underlying financial health and gives great insight into opportunities for your business.

A bookkeeping service does more than just record payables and receivables, or manage payroll services, they guarantee the security, scalability, and success of your business. Our bookkeeping service options are designed to cater to businesses of all sizes, with pricing tiers based on your company’s average monthly expenses over a period of 3 consecutive months. Decimal’s bookkeeping service offers automatic transaction categorization, bank reconciliation, and bookkeeping journal entries. You also get on-demand reports, so you can see how your business is doing at any time. Its monthly price starts at $295 per month, plus an onboarding fee and it doesn’t require a long-term commitment.

Bottom Line: An Accountant or bookkeeper will help you

Your records file must be in order and correspond to your bank statements, receipts, cancelled checks, and tax deductions. We know that you are not accountants. So, if and when you run into an issue regarding taxes, just let us help you out. We will be glad to work with you to get you set up! Simply provide us with your CPA’s email address and we’ll keep them in the loop on all communication and work with them to make sure they have what they need. Business tax preparation relies on good records.

Supporting Documentation

The IRS has changed the rules regarding the computations and Filing of Federal Tax Returns. It is now the responsibility of the Preparer to attest to the data. This forces the tax Preparer to rely on the businesses Bookkeeping Service data when compiling their totals. Every line item on the Returns must have supporting documentation. When using our Business form, provide documentation of the original documents in different File folders.

Substantiate the figures for the IRS

Taxpayers must substantiate the figures at the time the Federal Returns are completed for the IRS. Taxpayers must state their figures for their Taxes are true and correct and they would need to substantiate those figures to the IRS upon request. The information taxpayers submit to us should be true, complete and accurate.

We request that the business should have true and trusted totals based on the reliable supporting documents that bookkeeping services provide for Filing Taxes. The supporting documents should be available during the preparation process if needed. Moreover, they should be available in case the IRS requires the taxpayer to produce them.

What are bookkeeping services and how can they benefit my business?

Bookkeeping services involve managing and recording financial transactions for a business. They can benefit your business by providing accurate and up-to-date financial records, helping with budgeting and forecasting, ensuring compliance with tax laws, and allowing you to focus on core business activities.

What are some common bookkeeping mistakes and how can a bookkeeping service help avoid them?

Some common bookkeeping mistakes include overlooking receipts, failing to reconcile accounts, and misclassifying expenses. A bookkeeping service can help avoid these mistakes by providing expert oversight, implementing proper record-keeping procedures, and ensuring accurate financial reporting.

How often should I use a bookkeeping service to ensure accurate financial records?

To ensure accurate financial records, it is recommended to use bookkeeping services on a regular basis. Depending on the size and complexity of your business, using bookkeeping services monthly or quarterly can help maintain accurate records and provide timely insights into your financial health. Having these records will help you make correct estimated tax payments during the year so that you can avoid underpayment penalties.

What are the different pricing options for bookkeeping services, and which one is right for me?

Bookkeeping services typically offer different pricing options such as hourly rates, monthly packages, or customized plans based on your business’s specific needs. It’s important to assess the complexity of your bookkeeping requirements and budget constraints to determine which option is the best fit for you.

What exactly are bookkeeping and accounting services?

Bookkeeping services involve recording financial transactions, maintaining financial records, and reconciling accounts. Accounting services go beyond bookkeeping and involve analyzing financial data, preparing financial statements, providing tax advice, and offering strategic financial guidance to businesses.