Income Tax Recordkeeping Tips: Maximize Your Tax Deductions

Income Tax Recordkeeping Tips for Your Small Business:

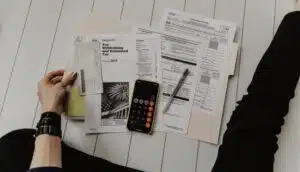

Proper Income Tax Recordkeeping Is Essential for Your Small Business. As a small business owner, you are responsible for keeping track of your income and expenses, including individual income tax. Your ability to properly “account” for your financial transactions in your business affects how much taxes you end up paying. This is important for tax purposes, as well as to help you keep track of your business’s progress.

One essential task in tax recordkeeping is maintaining accurate records of all transactions. This will make tax time much easier on you and will also help to ensure that you are paying the correct amount of taxes.

We recommend that every business has some sort of system to track every business expense. You can use a paper ledger, excel spreadsheet, QuickBooks or Quicken and even a smartphone app. If you don’t know how or don’t want to do this…hire a small business accountant to do it for you! Most importantly, this is a necessary function that you must complete to generate reports. These reports should provide you with a snapshot picture of how well your business is doing and provide totals at the end of the year that you need to complete your tax returns.

In this blog post, we will discuss some tips for tax recordkeeping and the importance of keeping good records year-round! Read more about original docs for proper RecordKeeping blog.

7 Useful Income Tax Record keeping Tips for Your Small Business

If you’re a small business owner, income tax recordkeeping is an essential task. Proper record keeping will help you at tax time and throughout the year. Here are seven tips to help you keep accurate records: See our Record Keeping Story

1) Deductions: Keep Track of All Income and Expenses:

As a small business owner, it is important to keep track of all of your income and expenses. This will help you when it comes time to file your taxes. You can use a variety of methods to track your income and expenses, including a spreadsheet, software program, or even a handwritten ledger. Whichever method you choose, be sure to update it regularly and keep it organized. Additionally, make sure to save any receipts or invoices that are related to your income and expenses. This documentation can be helpful if you ever have to prove your deductions to the IRS. By staying organized and keeping good records, you can ensure that your small business’s tax time is as smooth as possible. Learn about business gift deductions.

2) Establish Business Bank Accounts:

Another important tip for income tax recordkeeping is to establish separate business bank accounts. This will help you keep track of your business’s finances and make filing your taxes easier. When you have separate business accounts, all your business-related income and expenses will be in one place. This can save you a lot of time and headache come tax time. Additionally, having separate accounts can help you to prove to the IRS that your business is a legitimate operation.

3) Keep Good Documentation of Business Mileage:

If you use your personal vehicle for business purposes, good income tax recordkeeping requires good records of your mileage. This is because you can deduct business-related mileage from your taxes. In order to deduct your mileage, you will need to keep track of the miles you drive and have a record of the purpose of the trip. You can use a mileage tracking app or simply keep a written log of your business-related trips. However, you choose to track your mileage, be sure to do it consistently so that you have accurate records come tax time.

4) Burden of Proof for Business Taxes:

When it comes to business taxes, the burden of proof is on the business owner. It is up to you to prove to the IRS that your deductions, including bookkeeping and 1099s, are legitimate. Therefore, good income tax recordkeeping and documentation of all income and expenses, such as receipts, invoices, bank statements, and more, is important. This documentation can help you back up every item on your individual tax return and ensure that you are able to prove your deductions and avoid any penalties from the IRS.

5) Stay Organized Throughout the Year:

One of the best income tax recordkeeping tips is to stay organized throughout the year. This means keeping track of your income and expenses on a regular basis. Additionally, it is a good idea to set up a system for organizing your records, such as using personal finance software. This can be as simple as creating monthly folders or using a software program to track your finances. By staying organized with the help of personal finance software, you can save yourself a lot of time and headaches come tax time.

6) Hire A Professional:

If you are feeling overwhelmed by the task of tax recordkeeping, you can always hire a professional to help you. There are many accountants and tax preparers who specialize in small business taxes. They can help you keep track of your income and expenses and ensure that you take all the deductions you are entitled to. Hiring a professional can be a great way to take the stress out of tax time. Seminar Business deductions are another way to lower your taxes.

7) Purchase the Right Accounting Software:

If you decide to do your own taxes, purchasing the right accounting software is important. This software can make it much easier to keep track of your income and expenses and prepare your tax return. There are many different types of accounting software available, so be sure to do some research to find the best option for your small business. By purchasing the right software, you can save yourself a lot of time and hassle come tax season. Additionally, using the software can help ensure that you accurately calculate your tax due and maximize your deductions.

Why Is Proper Tax Record Keeping Essential for Your Small Business?

Many small business owners are surprised to learn just how important keeping records is to the success of their business. It ensures that you are compliant with the law and can also help you optimize your deductions and minimize your tax liability. Furthermore, good record-keeping habits can help you track the financial health of your business and make informed decisions about its future. Keeping records enables you to explain an item on your return if the Internal Revenue Service (IRS) questions you about it in an audit. Additionally, records could shorten the time collecting insurance, military benefits, veterans benefits or an income tax refund can take. You will need to keep these records for a number of years.

Important Things That You Should Keep In Mind:

There are a few key things you should remember when it comes to tax record keeping.

1) Keep Meticulous Records:

First of all, you need to keep meticulous records of all of your income and expenses, including revenue and sales, the cost of goods sold, and operating expenses. By tracking all of this information, you can accurately prepare your tax return and take advantage of all the deductions and credits you are entitled to. Good records are a must in order to prepare detailed and accurate financial statements, such as income (profit and loss) statements and balance sheets. These statements can help you in dealing with your bank or creditors and help you manage your business. Remember, an income statement shows the income and expenses of the business for a given period of time.

2) Keep Track of Your Asset Record

Another important aspect of tax record keeping is tracking asset purchases and improvements, including rental property. This includes everything from office equipment and furniture to vehicles and real estate. By tracking these expenses, you will be able to maximize your depreciation deductions and minimize your capital gains taxes when it comes time to sell the asset.

Additionally, it is crucial to report the purchase date and price of your investments and property when filing your taxes. This information is used to establish your cost basis, which is the original price you paid for the asset along with any other costs associated with acquiring it. Your cost basis will determine your taxable gains or losses when you sell the investment, ensuring accurate reporting and compliance with tax regulations. If you sell your primary residence, those filing individual returns can exclude up to $250,000 in gains from taxes, and couples filing jointly can exclude up to $500,000.

3) Keep Good Record Throughout the Year

Finally, keeping good records of your business activities throughout the year is important for optimizing Tax Deductions. This includes everything from marketing initiatives and customer acquisition costs to employee training expenses. By tracking all of this information, you will be able to create an accurate picture of your business’s profitability and make sound decisions about its future.

In short, proper tax record keeping is essential for any small business owner who wants to be successful. By tracking your income and expenses, you can ensure that you comply with the law, minimize your tax liability, and maximize your deductions. Furthermore, good record-keeping habits will help you track the financial health of your business and make informed decisions about its future.

IRS Requirements for Receipts:

Deductions are essential to the tax code and can lower your taxable income. Some common deductions include charitable donations or business expenses. However, there is a list that includes more than just these two choices, childcare payment, for example.

If you plan on claiming any type (or all) of Deduction, then we must verify our claimed expense with documentation and maintain adequate records as such in order during audit inspections by external agencies like the IRS. They have specific requirements regarding types/sizes of evidence needed when proving valid claims etc. Let’s go over what the IRS requirements for receipts are:

The requirements for receipts are as follows:

1) Documentary Evidence:

The Internal Revenue Service (IRS) requires that taxpayers have documentary evidence to support their claims of expenses, credits, and deductions, including retention of tax records. This evidence must be in the form of receipts, canceled checks, bills, or other written documentation.

The IRS also requires that taxpayers keep these records for at least three years after filing their taxes. In some cases, the IRS may require taxpayers to keep records for longer periods of time, such as indefinitely for certain income tax returns. For example, taxpayers who make estimated tax payments must keep records of these payments for at least four years.

Additionally, taxpayers should retain records for six years if they underreport income and it’s more than 25% of their gross income. The requirements for receipts can be confusing and overwhelming for taxpayers. However, it is important to remember that the IRS only asks for existing documentation. Taxpayers should not go out of their way to create additional receipts or documentation. As long as they have records of their expenses, credits, and deductions, including retention of tax records and their gross income, they should be able to meet the IRS requirements.

2) Documentary Evidence Exceptions:

Most taxpayers choose the standard deduction when they file their taxes. However, if you itemize your deductions, you may be able to deduct certain expenses, such as mortgage interest. In order to deduct these expenses, you must have documentary evidence, such as receipts, canceled checks, or bills.

There are a few exceptions to this rule. For example, you do not need a receipt for charitable contributions if you donate cash or property valued at $250 or less. You also do not need receipts for educational expenses if you are claiming the Lifetime Learning Credit. You can consult the IRS website or speak to a tax advisor if you have questions about what documentation is required.

3) Scanned Receipts:

The IRS accepts scanned copies of receipts as long as they are legible. You should keep the original receipts in a safe place in case you are audited. You can also take pictures of your receipts and store them electronically. Be sure to keep all supporting documentation, such as bills, canceled checks, or bank statements, in case you are audited.

4) Time Frame:

The IRS requires that taxpayers keep records of their expenses, credits, and deductions for at least three years from the date they filed their original return. In some cases, the IRS may require taxpayers to keep records for longer periods of time, such as the statute of limitations on conducting audits. For example, taxpayers who make estimated tax payments must keep records of these payments for at least four years. You should speak to a tax advisor if you have questions about how long to keep your records.

Tax Audit: Physical Vs. Digital Receipts

Most taxpayers dread the idea of being audited by the IRS. One of the key pieces of evidence that the IRS will examine during an audit is receipts. This can create a daunting task for taxpayers who have yet to switch to a digital format for their receipts. Taxpayers should be aware of the benefits and drawbacks of both physical and digital receipts before an audit.

1) Physical Receipts:

Physical receipts provide a tangible way to track expenses. They can be stored in a shoebox or filing cabinet and easily accessed when needed. However, physical receipts can also be lost or damaged, making them less reliable than digital records. In addition, it can be time-consuming to file and organize physical receipts.

2) Digital Receipts:

Digital receipts offer a more convenient and organized way to store tax documents. They can be easily emailed or stored in the cloud, making them accessible from anywhere. However, digital records can be susceptible to hacking and data breaches. In addition, it is important to ensure that digital records are backed up in multiple locations to avoid losing them entirely.

At the end of the day, it is up to each taxpayer to decide which type of receipt storage is right for them. Some taxpayers may prefer the peace of mind of having physical records, while others may find digital storage more convenient. Whichever storage method is chosen, it is important to keep meticulous records in case of an audit. For detailed advice on which records to keep, taxpayers can refer to IRS Publication 552, which offers guidance on organizing and filing tax material, whether in hard copy or electronic form.

Conclusion

Income Tax Recordkeeping may seem like a daunting task but following these simple tips on tax topics will help make the process of tax filing easier and less time-consuming. By keeping track of your expenses and income throughout the year, you’ll be able to file your taxes easily and avoid any IRS penalties. These tax recordkeeping tips on tax topics are essential for small business owners, so be sure to follow them closely! Have you tried using any of these methods for tracking your finances?

FAQs

Why is it important to keep accurate income tax records?

Keeping accurate income tax records is important for several reasons. It helps ensure compliance with tax laws, enables accurate reporting of income and deductions, reduces the risk of audits and penalties, and allows for easy retrieval of information in case of tax disputes or inquiries.

How long should I keep my income tax records?

You should keep your income tax records for at least three years from the date you filed your original tax return or two years from the date you paid the tax, whichever is later. However, it’s recommended to keep them for up to seven years in case of audit or if you need to file an amended tax return.

Can I use electronic or digital records for income tax purposes?

Yes, you can use electronic or digital records for income tax purposes. The IRS accepts both paper and electronic records as long as they accurately reflect your income and expenses. It’s important to keep backups of electronic records and ensure they are easily accessible in case of an audit.

Also Read

1. Tax Service