When it comes to taxes, understanding the federal tax filing deadline is crucial for every taxpayer. The deadline typically falls on April 15th each year, unless it lands on a weekend or holiday, in which case it may be extended to the next business day. This date marks the culmination of a year’s worth of financial activity, and timely submission is essential to avoid penalties and interest fees.

Failing to file your taxes by this deadline can lead to significant consequences. Here are some key points to consider:

- Penalties: The IRS imposes a failure-to-file penalty, which can amount to 5% of the unpaid taxes for each month that your return is late.

- Interest: In addition to penalties, interest accrues on any unpaid tax balance, increasing your overall liability.

- Refund Delays: If you are entitled to a refund, filing late can delay your reimbursement. Filing on time ensures you receive any owed money promptly.

To help you stay on track, it’s advisable to keep accurate records throughout the year and start preparing your taxes early. If you find yourself overwhelmed or uncertain about the filing process, consider seeking assistance from professionals who specialize in tax preparation.

Akron Income Tax Co is committed to providing income tax preparation services at reasonable fees. Visit apc1040.com for more information and to ensure your taxes are filed on time!

Key Dates for Federal Tax Filing Deadlines

Understanding the key dates for federal tax filing deadlines is essential for effective tax planning. Here are some important dates to keep in mind:

- January 31: This is typically the deadline for employers to send out W-2 forms to employees, as well as for businesses to provide 1099 forms to independent contractors. Having these documents in hand will help you accurately prepare your tax return.

- March 15: Except for special circumstances, Corporate taxes, Partnerships and Trusts and Estate Returns. Taxpayers must file their returns or request an extension by this date.

- April 15: The primary federal tax filing deadline for most individuals falls on this date. If it falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers must file their returns or request an extension by this date.

- October 15: If you filed for an extension, this is your final opportunity to submit your tax return. Extensions allow you additional time to gather your documents but do not extend the time to pay any tax owed.

- Estimated Tax Payment Deadlines: For those who are self-employed or have other income that isn’t subject to withholding, estimated tax payments are due four times a year: April 15, June 15, September 15, and January 15 of the following year.

It is important to mark these dates on your calendar and prepare accordingly. Missing these deadlines can lead to penalties and interest, compounding your tax liabilities.

Consequences of Missing the Tax Filing Deadline

Failing to meet the tax filing deadline can have serious repercussions that affect both your finances and your peace of mind. Here are some of the primary consequences you might face:

- Penalties: The IRS imposes a failure-to-file penalty, which is typically 5% of the unpaid taxes for each month your return is late, up to a maximum of 25%. Additionally, if you owe taxes and fail to pay by the deadline, you may incur a failure-to-pay penalty, which is usually 0.5% per month on the unpaid amount.

- Interest Charges: Interest accrues on any unpaid taxes from the due date until the date of payment. The interest rate is set quarterly and compounds daily, making it crucial to pay your taxes on time to avoid escalating costs.

- Loss of Refund: If you are owed a tax refund and fail to file within three years of the original due date, you may forfeit your right to claim that refund entirely.

- Increased Scrutiny: Missing the deadline can trigger closer scrutiny from the IRS, which might lead to audits or demands for additional documentation.

- Stress and Anxiety: Beyond financial implications, failing to file on time can create significant stress. The worry of penalties, audits, and the overall complexity of tax issues can weigh heavily on your mind.

To avoid these challenges, it is essential to stay organized and proactive about your tax filings.

Tips for Meeting the Federal Tax Filing Deadline

Meeting the federal tax filing deadline is crucial for maintaining your financial health and avoiding penalties. Here are some practical tips to help you stay on track:

- Start Early: Don’t wait until the last minute to gather your documents. Begin collecting your income statements, receipts, and any other necessary paperwork as soon as you receive them.

- Organize Your Documents: Create a system for organizing your tax materials. Use folders or digital tools to categorize documents by type, such as income, deductions, and credits. This will save you time and reduce stress when filing.

- Use Tax Preparation Software: Consider using reliable tax software to simplify the filing process. Many programs guide you through each step and help ensure that you don’t miss any important deductions or credits.

- Stay Informed: Keep up with any changes in tax laws that may affect your filing. Understanding the current tax rules can help you make informed decisions and maximize your benefits.

- Seek Professional Help: If your tax situation is complex or you feel overwhelmed, don’t hesitate to consult a tax professional. They can provide valuable insights and assistance in meeting the deadline.

- Set Reminders: Use digital calendars or reminder apps to alert you as the deadline approaches. Setting multiple reminders can help ensure you don’t overlook this important date.

By following these tips, you can streamline your tax preparation process and confidently meet your filing obligations.

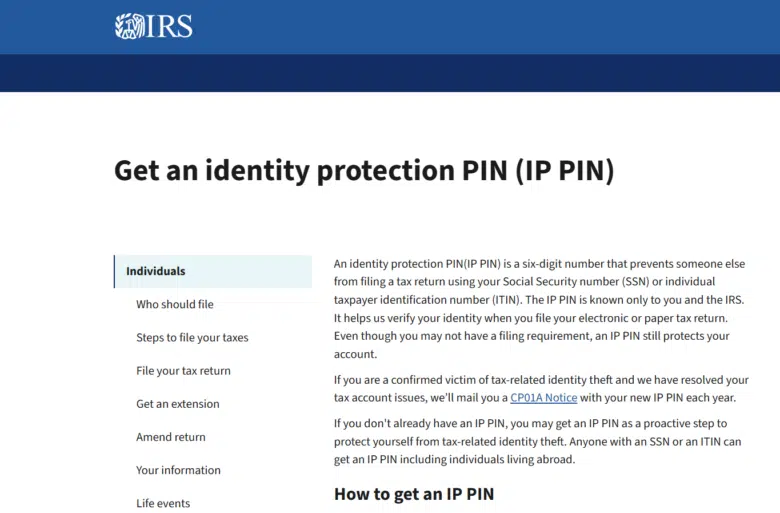

How to File for an Extension on Your Taxes

If you find yourself unable to meet the federal tax filing deadline, filing for an extension can provide you with additional time to prepare your return. Here’s how to navigate the extension process:

- Understand the Extension Form: To request an extension, you will need to complete Form 4868, which is the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. This form can be submitted electronically or via mail.

- File on Time: Ensure that you file Form 4868 by the original tax deadline. This is crucial because failing to submit the form on time can result in penalties.

- Estimate Your Tax Liability: When filing for an extension, it’s essential to estimate your tax liability as accurately as possible. If you owe taxes, you should pay any estimated amount to avoid interest and penalties.

- Check State Requirements: Remember that your state may have its own extension process. Check with your state tax agency for specific forms and deadlines.

- Keep Records: After submitting your extension request, make sure to keep a copy of the form and any confirmation received. This documentation is important in case of any future inquiries.

- Know the Extension Period: An extension typically gives you an additional six months to file your federal tax return, moving the deadline to October 15. However, it’s important to note that this extension is only for filing your return, not for paying any taxes owed.

By following these steps, you can successfully file for a tax extension and alleviate the pressure of meeting the original deadline while ensuring compliance with tax regulations.

Final Thoughts on Federal Tax Filing Deadline

As the federal tax filing deadline approaches, it’s essential to remain proactive and informed. Understanding the importance of timely submissions can significantly impact your financial situation. Missing the deadline can lead to penalties, interest on unpaid taxes, and increased stress during what is already a busy season.

Here are some final thoughts to consider:

- Stay Organized: Gather all necessary documents, such as W-2s, 1099s, and receipts for deductions, well in advance. This preparation can streamline the filing process.

- Consider Professional Help: If your tax situation is complex, seeking assistance from a tax professional can save you time and potentially increase your refund.

- Utilize Technology: Take advantage of tax preparation software or online services that offer user-friendly interfaces to guide you through the filing process.

- Don’t Delay: The earlier you start working on your taxes, the more time you will have to address any issues that arise.

Being aware of the federal tax filing deadline and taking proactive steps can help you avoid common pitfalls. If you find yourself needing assistance or have questions about your tax situation, Akron Income Tax Co is committed to providing income tax preparation services at reasonable fees. Visit us at apc1040.com to learn more about how we can help you this tax season.