What is IRS Form 8960, and Who Needs to File it?

When tax season rolls around, most high-income earners face a maze of forms and rules. One of the most overlooked yet important among them is IRS Form 8960. This form is used to figure out the Net Investment Income Tax (NIIT), a 3.8% surtax applied to individuals, estates, and trusts with investment income. It’s not part of the standard tax filing process for everyone but it becomes necessary when certain income thresholds are met.

This article will cover everything you need to know about Form 8960, why it exists, who needs to file it, how to calculate your tax using it and what types of income are included or excluded. Whether you’re a taxpayer, financial advisor or estate executor, understanding this form is crucial for accurate and legal tax compliance.

What is IRS Form 8960 and Why Does it exist

The Internal Revenue Service created Form 8960 as the official form for taxpayers to calculate their Net Investment Income Tax (NIIT) liability. This special tax form is the mechanism through which high-income earners report and pay this surtax on their investment income.

Purpose of the 8960 form

Form 8960 serves one primary function: to calculate the Net Investment Income Tax owed by qualified taxpayers. The IRS created this form to handle the complexity of this tax instead of including this calculation in other tax forms. Taxpayers must attach the completed Form 8960 to their regular tax returns (Form 1040 for individuals or Form 1041 for estates and trusts).

Furthermore, the form provides a structured way to calculate the investment income subject to tax. Through its three-part structure, Form 8960 guides taxpayers through reporting investment income, deducting expenses and calculating the final tax amount.

How does it relate to the Net Investment Income Tax

The Net Investment Income Tax (NIIT) applies a 3.8% flat tax on specific types of investment income for individuals whose income surpasses certain thresholds. Form 8960 is the form that makes this tax happen by providing the framework to determine if the tax applies and how much is owed.

In short, the form implements the tax formula in the Internal Revenue Code: taxpayers pay 3.8% on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold.

So Form 8960 is only necessary when both conditions exist—having investment income and exceeding the MAGI thresholds. The form also helps distinguish between the NIIT and the Additional Medicare Tax, which started at the same time but work differently.

Who created the NIIT and why

The Net Investment Income Tax was part of the Patient Protection and Affordable Care Act and took effect in January 2013. Congress created this tax to generate revenue to fund healthcare reforms passed in 2010. The tax was also known as the “Unearned Income Medicare Contribution” and the “Medicare Contribution Tax on Unearned Income” – its purpose was clear.

This tax was created to help fund Medicare by applying to unearned investment income. Before the NIIT, Medicare was primarily funded through payroll taxes on earned income. By implementing the NIIT, lawmakers expanded the tax base to include passive investment earnings held by higher-income individuals.

The tax is enforced through Section 1411 of the Internal Revenue Code and the IRS issued proposed regulations in December 2012.

Who needs to file IRS Form 8960

Filing requirements for Form 8960 depend on two key factors: having investment income and exceeding certain income thresholds. Not everyone with investments needs to worry about this form only those whose finances cross certain lines set by the IRS.

MAGI thresholds by filing status

The IRS sets different Modified Adjusted Gross Income (MAGI) thresholds by filing status. Individuals must file Form 8960 when their MAGI is:

- $250,000 is available for married couples filing jointly or for individuals who qualify as surviving spouses.

- $200,000 for single filers or heads of household

- $125,000 for married individuals filing separately[121]

Unlike many other tax limits, these amounts do not adjust for inflation. So more taxpayers will become subject to this tax over time as incomes naturally rise with inflation.

When investment income triggers the tax

Form 8960 is only necessary when both conditions exist. First, the taxpayer’s MAGI must be higher than the applicable threshold. Second, they must have net investment income.

Of course, even if your MAGI exceeds the threshold, you don’t need to file Form 8960 if you have no investment income. Conversely, having substantial investment income doesn’t trigger the requirement if your MAGI is below the threshold.

Nonresident aliens are an exception to these rules as they are generally not subject to the Net Investment Income Tax.

Special rules for estates and trusts

Different rules apply to estates and trusts. These entities must file Form 8960 if they have undistributed net investment income and adjusted gross income over $15,200 for the 2024 tax year.

But certain trusts are exempt from this filing requirement. These include charitable trusts, qualified retirement plan trusts, grantor trusts and several other specialized trust types.

For qualifying estates and trusts, the 3.8% tax applies to the lesser of their undistributed net investment income or the amount by which their adjusted gross income exceeds the threshold.

What is net investment income?

Understanding what income is included in the Net Investment Income Tax (NIIT) calculation is key to determining if Form 8960 applies to your situation. The IRS clearly defines which types of income are included in this 3.8% surtax.

1) Interest and dividends

The IRS identifies various forms of income as investment income subject to the NIIT. Interest income, for example, comes from sources like bonds, savings accounts, certificates of deposit (CDs), and Treasury securities.

Dividends from stock investments also count towards NIIT, including both qualified and non-qualified dividend payments. These basic investment income sources will appear on Part I of Form 8960 where taxpayers list various types of investment income earned during the tax year.

2) Capital gains and rental income

Capital gains are another big component of net investment income. This includes profits from selling stocks, bonds, mutual funds, cryptocurrency and other investment assets. Gains from selling investment real estate (excluding a portion of gains from selling a primary residence) also fall into this category.

Rental income from investment properties also qualifies as net investment income. This includes profits after deducting expenses related to the property. But certain rental activities may be excluded if they qualify as part of an active trade or business where the taxpayer materially participates.

3) Excluded income types (e.g., retirement distributions)

Importantly, not all income triggers NIIT obligations. Excluded income types primarily include Wages and salaries from employment, Self-employment income, Social Security benefits, Tax-exempt interest (such as municipal bond earnings), Distributions from qualified retirement plans like 401(k)s and IRAs, Alaska Permanent Fund dividends, and Unemployment compensation.

4) Passive business income and royalties

Passive business income affects NIIT calculations. Income from businesses where you don’t materially participate counts towards net investment income. Earnings from buying and selling financial products or goods also count.

Royalty income from intellectual property, natural resources or licensing agreements typically counts as investment income subject to NIIT. Annuity distributions from non-qualified plans also fall under this category.

Calculate your NIIT using IRS Form 8960

Form 8960 breaks down the NIIT calculation process into three distinct parts, each serving a specific purpose in determining your tax liability. Accordingly, completing this form requires a methodical approach to ensure accurate reporting of your investment income.

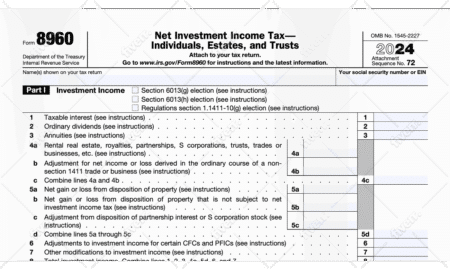

Part I: Reporting investment income

The first section of IRS Form 8960 requires listing all investment income sources. Initially, you’ll enter taxable interest on Line 1, ordinary dividends on Line 2, and income from annuities from nonqualified plans on Line 3. Subsequently, you’ll report rental income, royalties, and income from partnerships, S corporations, and trusts on Line 4a.

Furthermore, this section includes capital gains from investment property sales and other investment income types. Special reporting rules apply to certain investments, such as controlled foreign corporations (CFCs) or passive foreign investment companies (PFICs).

Part II: Deducting investment-related expenses

Once you’ve totaled your investment income, Part II allows deductions for expenses directly connected to generating that income. These typically include:

- Investment interest expenses

- State, local, and foreign income taxes attributable to investment income

- Investment advisory and brokerage fees

- Tax preparation fees related to investments

The IRS permits using a “reasonable method” to allocate expenses between investment and non-investment activities. Worth noting, personal expenses and charitable contributions aren’t deductible for NIIT purposes.

Part III: Final tax computation

In this section, you’ll determine whether the NIIT applies to you and calculate the amount owed. The tax equals 3.8% of the smaller of:

- Your net investment income (from Line 12)

- The amount of your Modified Adjusted Gross Income (MAGI) that goes over your tax filing limit.

For professional assistance with complex tax situations, visit Apc1040.com, where tax experts can help navigate the intricacies of investment tax reporting.

Example

Let’s look at a married couple filing jointly. They earned $30,000 in net investment income, which is $260,000 in their Modified Adjusted Gross Income (MAGI).

Their threshold for NIIT is $250,000, so their MAGI goes $10,000 over the limit.

Since $10,000 is less than their $30,000 in net investment income, the Net Investment Income Tax (NIIT) is based on the smaller amount.

Calculation: $10,000 × 3.8% = $380. They will report this $380 tax on their Form 1040.

Conclusion

IRS Form 8960 may seem like just another line item on your tax return but it has real money implications for high income earners. The NIIT is a specific extra tax that applies only if your income is over a certain limit and you have passive income. And since the thresholds are not adjusted for inflation more and more taxpayers are being hit with this tax every year.

Keep good records and work with professionals to ensure you are in compliance and not overpaying. Whether preparing your taxes or working with an advisor, understanding Form 8960 will help you plan better and possibly reduce your tax.

Need Investment Tax Help? Don’t go it alone. Go to Apc1040.com and contact tax professionals who specialize in investment income, estates and trusts.