Learn how LLCs file their federal tax returns, including key forms, tax obligations, and tips for maximizing deductions and credits.

Lots of important Information on Taxes

Do LLCs File Federal Tax Returns? Here’s What You Need to Know

Discover if LLCs need to file federal tax returns, the different tax classifications, and essential filing requirements in this comprehensive guide.

What Is the Federal Tax Filing Deadline? Find Out Now!

Learn about the federal tax filing deadline, its significance, and essential tips to ensure timely submissions. Don’t miss your tax deadline!

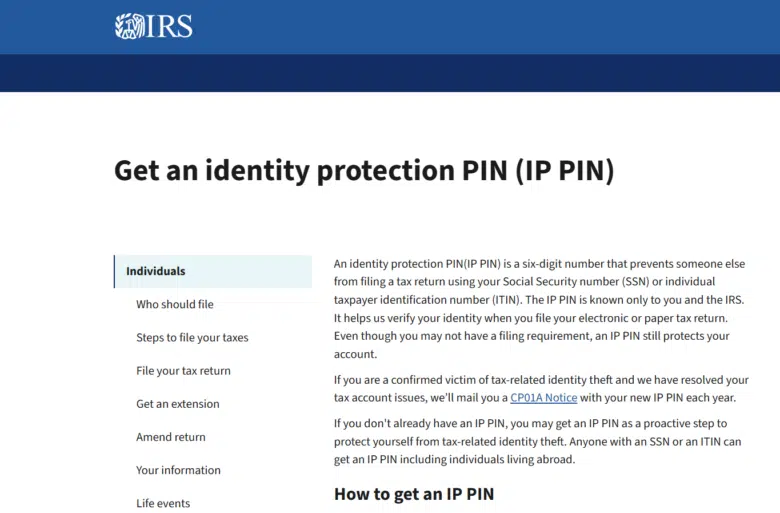

Learn how to Get an IRS Protection PIN for yourself and your Kids

Why Your Federal Tax Return Is Lower Than Expected

Discover common reasons why your federal tax return is lower than expected and how to address them effectively for better financial planning.

Understanding Sale Expenses from the Sale of Stocks

Explore the intricacies of sale expenses from stock sales, including types, tax implications, and how to manage them effectively.

Understanding The Qualifying Child Test for Dependents

Explore the Qualifying Child Test for dependents, including eligibility criteria, benefits, and important considerations for tax purposes.

How Much Must a Small Business Make to File Taxes?

Discover the income threshold for small businesses to file taxes, understanding requirements, exceptions, and tax filing tips for compliance.

Proper Way to Pay Your Kids for Tax Savings in Business

Learn how to pay your kids to save on taxes in your business. Discover legal strategies and maximize tax savings effectively.

How Many Years of Income Tax Returns Should I Keep?

Discover how many years of income tax returns you should keep and why it’s important for financial and legal security. Essential tips included.