Available Basic Tax Prep Forms

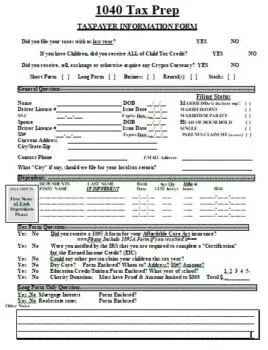

Tax Information Form

Business Form

Rental Form

These available Basic Tax Prep Forms will assist and guide you in getting ready for your appointment for Taxes. Basic Prep forms for Taxes for clients from Akron Income Tax Preparation. Especially when you plan to drop off your information. You don’t really need the basic Tax Information form when you have a face-to-face appointment for your Returns, but it is nice, especially if you are a new client.

Tax Information Form is for the 1040 tax return: This is the basic form for individual taxpayers. It includes your personal information, income, deductions, and tax liability.

Business Form is for taxpayers who file the Schedule C Form: This form required for businesses and for people who receive a 1099NEC form.

Rental Form is for Schedule E filers: This form is used to report your income and expenses for taxpayers who own rental property.

Other Important Tax Forms

These are the most commonly used Federal Tax Return forms, but many others may apply to your specific situation. We will help you determine which forms you need to complete in order to File your Taxes

The purpose of these Filing these forms for Taxes is twofold. First, to help you get started in assembling your important documents for Taxes. Thereby assisting in the start of the Federal Tax Preparation process. Second, by filling out our form the information it provides reduces the amount of time it takes to File your Returns.

What Documents You Should Bring to Your Appointment for Taxes:

The following is a list of documents that you will need to bring with you to your appointment for Taxes. This list is not all-inclusive, but it will give you an idea of the essential documents that we will need in order to prepare your Tax Return.

- A copy of your last year’s Tax Return (if you are a new client)

- W-2 forms from all employers

- 1099 forms (if you are self-employed or have interest or dividends)

- All records of income and expenses for your business (if you are self-employed)

- Records of any other income, such as alimony, child support, or pensions

- Interest and dividend statements from banks and other financial institutions

- Documentation of any deductions or credits you plan to claim, such as charitable donations, medical expenses, or student loan interest

- A copy of your Social Security card or other official documentation of your Social Security number

- A valid photo ID (such as a driver’s license)

- Proof of any payments you have made, such as estimated tax payments or federal tax deposits

- If you are claiming the Earned Income Tax Credit or the Additional Child Tax Credit, you will need to bring proof of income and identification for each person listed on your return. Acceptable documentation includes W-2 forms, 1099 forms, pay stubs, or social security cards.

Just in case…

You may not need to bring all of these documents with you to your appointment, but it is helpful to have them available in case we need them.

If you have any unusual circumstances, please use the space in the Basic Tax Prep forms to communicate with us.

Call us to set up your appointment

Or Use our Remote File@Home option for basic Filers

Or Just Drop Off your Taxes and we will File them!