Cheap Tax Preparation $130

Filing your taxes every year does not have to cost you big bucks. We provide Cheap Tax Services for $130 in Akron, Ohio. Paying to prepare your taxes has become an ordinary yearly event in this modern era. Besides, there are lots of different tax services available to provide you with tax preparation. Some community organizations and nonprofits provide free tax preparation services, especially for specific populations like the elderly and low-to-moderate-income individuals.

These tax services include a complete guide to evaluating financial problems. Tax preparation services encompass different types of tax returns.

We can provide you with the low-cost taxes in Akron, Ohio, that you are looking for. Taxpayers look for reasonable-cost tax preparation firms. Why Pay More? Cheap Tax Services prepared for $130 for most types of returns except if you have Rentals or a Business or more than 5 stock sales.

All tax return types

Whether you are a small business owner looking for a basic tax form or running a business, you can still utilize Cheap Tax Returns to get different types of tax returns, including local and state tax returns. United Way created three versions of the MyFreeTaxes Self-Employed Tax Guides to meet the specific needs of general small business owners, gig economy entrepreneurs, and home-based childcare businesses. However, in this article, we will discuss all the main aspects of cheap tax services and the role of tax preparation services. Business tax preparation requires more knowledge and experience than just a simple return.

Additionally, CheapTaxUSA, a popular online tax service, allows you to import last year’s return from another service, like TurboTax, H&R Block, or TaxAct, making it convenient for users to access their previous tax information. If your AGI is below $73,000, you can file your taxes with free software through the IRS Free File program, which allows taxpayers with incomes below a certain threshold to use free commercial tax software for filing their taxes.

Use Free File Fillable Forms if your income is greater than $73,000. Free File software opens in January 2023. The alliance says that 70% of all taxpayers — about 100 million people — should be eligible to file their own tax return and prior year return free of charge each year through the Free File program on the IRS website, which can be compared to offers from various top tax software companies. Once you submit your return, the agency says you should get a confirmation email within two days.

Cheap Income Tax Preparation

Cheap income tax preparation services provide accurate and reliable tax services. The basic fee is $130 for most tax returns, including State City and E-filing for free. Small Business Taxes start at $220.

We are working to deal with your needs for income tax preparation. Moreover, if you hire an income tax preparation service, they ensure to provide you with the best outcomes at cheap rates.

Cheap rates do not mean bad. It means you don’t have to spend tons of your hard-earned money to get professional results.

Value of Cheap Tax Services

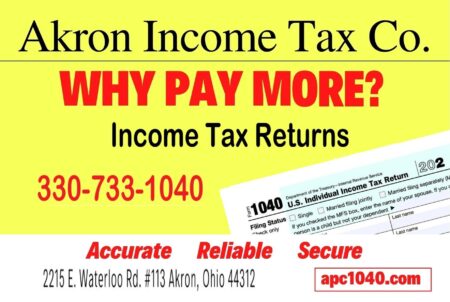

When you hire the best income tax services, they deal with you to provide you with everything that you want, including their best services. Akron Income Tax Co. is a popular and effective preparation firm that helps you with your tax problems and filing your taxes.

Unlike the big-box national firms that hire new people every year, we have experienced preparers who have been completing taxes for years. Experience counts. All these things matter when looking for income tax services in Akron, Ohio.

You must contact cheap tax services to get in-depth knowledge of taxation. Moreover, they help you with different income returns as well.

Tax Preparation

We can provide you with tax preparation that can meet your needs and budget. Thus, using our cheap tax service, you can effortlessly prepare your taxes for a reasonable fee. These income tax services help you to deal with your business and provide you with great opinions and the best solutions for DIY tax preparation, ultimately maximizing your tax deductions and refund dollars.

Cheap Tax Service

With our cheap tax service, you also have the added benefit of access to a premier tax expert who can provide step-by-step guidance and answer any questions you may have about filing an amended return. We have all the tax filing options you need, whether you prefer to file in our office or from the comfort of your own couch. And no matter which option you choose, you can always count on getting your maximum tax refund. Guaranteed.

Additionally, we offer the convenience of accepting payments through credit cards, providing you with more flexibility in paying your taxes. Our cheap tax service also comes with a 100% accuracy guarantee, ensuring that your taxes are filed correctly and without any errors.

The Goal of Income Tax Services

The basic goal of income tax preparation service is to maximize your refund legally. We have experienced people who provide you proper knowledge to refund taxes legally.

We are aware of the laws that can impact your returns. Thus, we offer full guidance of business, taxes, and preparation services at a very low cost.

If you are looking for cheap tax services, Akron Income Tax Co is the best option for you as we provide our customers with accurate, secure, and credible income preparation services at a low cost.

Benefits of Hiring Best Preparation Services

Best preparation services, such as Akron Income Tax Co, encourage you to review our services. The other benefits of connecting with a professional income tax company are given below;

- Experienced, thus they perfectly prepare your taxes.

- Free examination of your previous taxes.

- Complete your State, City and E-File

- Low tax prep fees and free tax help and tax counseling

- Our performance guarantee.

You should feel easy to get in touch with an experienced tax service, as we are experienced in providing cheap tax returns. Different tax services are working in Akron, Ohio. They include trained and professional accountants who help people by providing them with tax services.

Income Tax Return Preparation Services

The tax return services work to prepare your taxes. However, all the income tax return preparation services in Akron Ohio State, provide different types of tax returns, such as state, individual, business, and federal tax returns.

There are various resources and programs available to assist individuals in preparing and filing their federal tax return, including free help and specific online programs like IRS Free File and Direct File. Additionally, if you receive an IRS notice, our office is close to your area in Akron, Ellet, Goodyear Heights, Hartville, Kenmore, Mogadore, Green, Tallmadge, Uniontown, and Barberton, offering specific qualifications and a Record of Completion to ensure you get the assistance you need.

Benefits of Income Tax Return Preparation Services

Income tax return services provide you with easy and reasonable returns in a very legal way. It does not matter whether you are working individually or possess a small business. In both cases, you cannot manage your tax returns as they may cause a burden.

If you complete the tax return preparation by yourself, it can cause many problems for you, including the risk of missing tax credits; however, with the help of a well-trained tax preparation company or tax return preparation service, such as the tax services in Akron, Ohio, provide easy and cheap tax return services. Complex tax situations, like business, rental property, or other investment income, need experienced tax support.

Taxes Completed at Reasonable Rates

All of your problems can be solved at reasonable rates with the help of our tax return services. They offer you federal tax returns, state tax returns, partnership returns and even corporate returns. As they are well experienced, they know how to minimise liability.

Having the necessary tax documents for filing is crucial, and tax software can streamline the process by allowing users to upload these documents easily.

Moreover, with the help of cheap tax services in Akron, you can underrate the amount that you have to pay. Similarly, these services ensure that they efficiently maximize your refund. Here are some of the other benefits of using cheap tax return services. Check out our reasonable fees for Business Accounting.

We Make the Tax Preparation Process Easy

The return process can be hard and painful if you are trying it by yourself. However, with the help of cheap tax return services, the process becomes less painful.

They make sure to provide you with easy and timely services. Moreover, to make the whole process easier for you, they offer you the choice of dropping your taxes off. They’re even more reliable than any free tax software that may not give accurate student loan interest estimations and stats.

In case, you are not satisfied with the choice of dropping your taxes, the other option is to seek help from their well-trained preparers.

Besides, to complete the return process in a more efficient and timely manner, you must make an appointment with their professional preparers.

We Provide Fixed Pricing

Apart from the big box offices that may charge you a big amount for tax returns, the price would depend on your returns at a well-established income tax return company. There are some rules for all people, including business owners. Whether you purchase a short-form, long-form, or married form, you will get fixed prices. Cheap Tax Service Akron, all you have to pay is $130. There is no need to pay more as long as you seek help from professional income tax returns services.

Maximize your IRS Refund with an Earned Income Tax Credit

Whether you are looking for a business return or personal return preparation, the income tax return services make sure to provide you with the refunds in a more legal way. Their priority is to provide you with the best refund services.

The other thing they ensure is fulfilling all the legal requirements. Though many other services may determine to provide your tax returns at a very low rate, they are not real. Also, online tax preparation software options may not be reliable.

However, if you are looking for honest and real tax return services in Akron, Ohio, Akron Income Tax Co. is the best option for you. With affordable tax preparation fees, our tax professional experts provide the best services to file taxes for federal and state taxes.

Cheap tax services can help you claim the earned income tax credit (EITC). The EITC is a refundable tax credit for low to moderate-income earners, which can put extra money in your pocket during tax season. Some tax preparation services offer free plans that include the EITC and other tax credits, such as child tax credits and student loan interest tax deductions. Using these services can save money on tax preparation fees and get the most out of your tax return.

Accurate 1040 Tax Forms and Returns

The taxpayers use different IRS (Internal Revenue Service) forms to Calculate and pay any tax owed. The federal 1040 tax returns form can be used to calculate overall taxable income. Moreover, you can use this form to get accurate, reliable, and honest tax returns.

Filing the 1040 tax returns form is the easiest and using our cheap tax services is the best time-consuming way to get refunds back.

Free Tax Filing Options

If you’re looking for ways to file your taxes for free, there are several options available that can help you save money while ensuring your taxes are filed accurately and on time. Here are a few:

- IRS Free File: This program offers free tax filing to individuals with an adjusted gross income of $79,000 or less. You can access the program through the IRS website, making it a convenient option for many taxpayers.

- Volunteer Income Tax Assistance (VITA): This program provides free tax help to individuals with disabilities, limited English proficiency, or who are 60 years or older. VITA volunteers are IRS-certified and can assist with basic tax returns. You can find a VITA location near you on the IRS website.

- Tax Counseling for the Elderly (TCE): This program offers free tax help to people aged 60 or older. TCE volunteers specialize in questions about pensions and retirement issues specific to older adults. You can find a nearby TCE location on the IRS website.

- MilTax: This program provides free tax preparation and filing services to military personnel and their families. MilTax is available through the Military OneSource website and offers specialized support for military-specific tax situations.

These free tax preparation options can provide you with the assistance you need without the added cost, ensuring you get the most out of your tax return.

Tax Forms and Filing

When it comes to filing your taxes, there are several forms you may need to complete. Understanding these forms can help streamline the process and ensure you have all the necessary information:

- Form 1040: This is the standard form for personal income tax returns. It is used to report your income, claim tax deductions and credits, and calculate your tax refund or amount owed.

- Form W-2: This form shows your income and taxes withheld from your employer. Employers must send this form to employees by the end of January each year.

- Form 1099: This form shows income from freelance work, interest, dividends, and capital gains. There are several types of 1099 forms, each for different types of income.

- Schedule A: This form is used to itemize deductions, such as medical expenses, mortgage interest, and charitable donations. Itemizing can help reduce your taxable income if your deductions exceed the standard deduction.

Understanding the correct tax forms and their purpose can make the filing process smoother and help ensure you don’t miss any important information.

Tax Credits and Deductions

Tax credits and deductions can significantly reduce your tax liability, putting more money back in your pocket. Here are a few key credits and deductions to be aware of:

- Child Tax Credit: This credit is available to families with qualifying children under the age of 17. It can reduce your tax bill by up to $2,000 per child, and a portion of the credit may be refundable.

- Earned Income Tax Credit (EITC): This credit is available to low- and moderate-income working individuals and families. The amount of the credit depends on your income and the number of qualifying children you have. The EITC can be a substantial benefit, potentially increasing your refund.

- Standard Deduction: This is a fixed amount that can be deducted from your income without needing to itemize. For the 2024 tax year, the standard deduction is $15000 for single filers and $30,000 for married couples filing jointly.

- Itemized Deductions: These are expenses that can be deducted from your income, such as medical expenses, mortgage interest, and charitable donations. If your itemized deductions exceed the standard deduction, it may be beneficial to itemize.

Understanding and claiming these credits and deductions can help you maximize your tax refund and reduce your overall tax burden.

Comprehensive Guide to Tax Credits and Deductions

Tax credits and deductions can significantly impact your tax liability. Understanding these concepts is crucial for maximizing your tax savings. Tax credits, such as the Child Tax Credit and the Earned Income Tax Credit, directly reduce your tax bill. On the other hand, deductions, like those for educational expenses or charitable donations, reduce your taxable income. By leveraging these opportunities properly, you can optimize your tax return and potentially increase your refund amount. Familiarize yourself with available credits and deductions to make informed financial decisions.

Additional Resources

If you need additional help with your taxes, there are several resources available to provide support and guidance:

- IRS Website: The IRS website has a wealth of information on tax forms, filing, and credits. It’s a great starting point for any tax-related questions you may have.

- Taxpayer Assistance Centers (TACs): These centers offer free face-to-face help with tax questions and issues. You can find a TAC location near you on the IRS website.

- Financial and Legal Resources: Many organizations offer free or low-cost financial and legal resources. The National Foundation for Credit Counseling and the American Bar Association are two examples of organizations that can provide valuable assistance.

- State Taxes: You can find information on state taxes, including forms and filing deadlines, on your state’s tax website. Each state has its own tax regulations, so it’s important to stay informed about your state’s specific requirements.

These resources can provide the additional support you need to navigate the complexities of tax season and ensure your taxes are filed accurately and on time.

FAQs

What’s The Cost Of Tax Services?

The cost of tax services can vary depending on the complexity of your taxes and the provider you choose. However, many tax services are relatively affordable, especially when compared to the cost of hiring a professional tax preparer.

What Should I Look For In A Tax Service Provider?

When choosing a tax service provider, it’s essential to ensure that they are reputable and have a good track record. It would be best to compare pricing between different providers to make sure you’re getting the best deal. Next, make sure that they are open after April 15th if you need assistance. Finally, be sure to ask about any discounts or deals available.

What Are The Benefits Of Using Cheap Tax Services?

Using cheap tax services during tax time can save you money on your own taxes, used for other purposes. Additionally, it can help to simplify the tax preparation and maximum refund process and make it less stressful. By automating much of the filing process. using a tax service can also provide expert tax assistance.

Can I receive online tax assistance?

Yes, most preparers offer added benefit of online assistance. If you have a relatively simple tax return and don’t need in-person consultation from a tax professional but would still like some guidance, tax prep with an easy-to-use interface can be a huge help.

Utilize Tax Services Of Akron Income Tax Co

Several small businesses need professional tax services but baulk at high costs. However, some firms offer quality tax services at prices that won’t break the bank. Akron Income Tax Co is one of those firms. Our tax filers get their tax situation handled during tax season without breaking the bank.

We have been in business for a long time and have a wealth of experience. Providing tax services to small businesses. In addition, we offer a variety of other accounting and financial services that can benefit your business.

One of the best things about Akron Income Tax Co. is that we offer an initial consultation. This allows you to meet with us and discuss your specific needs. We will then tailor a package of services to meet those needs.

If you are looking for quality tax services at an affordable price, Akron Income Tax Co is a great option. Contact us today to schedule a free consultation.