Yes, Taxes Completed for just $130

Whether you are preparing your individual personal income Tax Returns or if you are a small business, completing the business returns yourself can be a serious burden and put you at risk for missed deductions and tax credits, including the child tax credit. Therefore, we offer Tax Preparation Services in Akron, OH, at a reasonable cost. Our cost for tax preparation is just $130 for clients who do not have a rental or business.

We offer personal individual (1040s), corporate Returns Taxes (1120s), partnership returns (1065s), and LLC income Preparation. Our services also include assistance for self-employed filers with Schedule C, ensuring that all necessary forms and deductions for business income are accurately completed.

We have experienced professionals on staff committed to reducing your overall liability and maximizing your legal deductions. Even the best software on the market cannot compare to having experienced tax professionals complete your return. Working with a professional ensures that you maximize your refund with the ever-changing laws.

To meet your individual needs, we offer several services to fit your life. No matter what your tax situation might be, we have a best Tax Preparation service for you in your local area!

What do you get with our services?

Our tax specialists understand the specific demands of each state. They can assist you in filing your taxes to ensure that they are done correctly. Our service gives you these benefits:

How to take Preparation, See this Video

Promotional Income Tax Preparation Video

When it comes to tax preparation, it is important to know the hours of operation and expert availability of your preferred service provider. Different companies have varying hours of operation and availability, which may change without notice. It is always a good idea to check ahead of time so you can plan accordingly. Many tax preparation providers now offer virtual services, making it more convenient for people to file their taxes from the comfort of their own homes. Check out our File@Home Tax option for expert availability.

An experienced Professional to Prepare your Returns

You will never feel like you are alone in this process. You can expect a team of knowledgeable tax experts committed to getting your tax prep right the first time. That means you will have a specialist tax expert to address all of your needs and queries. We will do the best job of providing you with excellent service, as soon as today, addressing any specific questions you may have. In addition, you will always know who you are dealing with and that your information is secure. Many preparers start on a small scale – doing individual returns – before moving on to bigger and more complicated matters. Tax preparers need to efficiently and securely access and manage confidential information for their clients. As a result, most preparers look for software to manage their workflow effectively and efficiently. Tax software should help preparers in the following ways: streamline data entry, perform accurate calculations, generate error-free tax returns, and ensure compliance with state license requirements or electronic filing identification numbers (EFIN).

A dedicated contact assigned to you personally

You will never be in the dark about our tax services. You will always have an assigned contact who knows you and your specific needs. This ensures that you will never be passed from one person to the next and that you will get the best possible service and care.

Review of previous Returns

We will also review your previous tax returns. This ensures that there are no errors, and additionally you get a jump start on seasonal preparations. This also allows us to offer guidance on deductions and credits you may have missed.

Electronic Filing (E-file) of your Federal and State Returns

Our service offers you the option to electronically file your Returns. This results in quicker refunds and a sense of security since you know your return was delivered successfully. We will prepare your return and send it to the IRS or State for electronic processing, which speeds up the process.

Federal tax filing is a mandatory task for all US citizens and residents. It is important to file federal tax returns on time to avoid penalties and interest charges, including any state penalty. The federal tax filing process can be made easier by using tax preparation software or hiring a tax professional. These programs make it easy to prepare and file federal tax returns accurately and quickly.

Maximum refund amount

Our goal is to offer you the maximum refund possible. We will ensure that your return contains all allowable deductions and credits to ensure your refund is as large as possible. You will never have to worry that you may be leaving money on the table with our tax service.

Accurate calculations of Tax liability

Tax laws are constantly changing, making it difficult for you to know what your tax liability is. You will get an accurate calculation of how much you owe to the IRS or State.

Free State and City Returns completed (w/Federal)

We offer Free State filing with your Federal Taxes. Tax Preparation Akron. This is an added benefit for our clients, ensuring that you are not paying out of pocket for services you have already paid for with your federal filing. You will also receive free city returns with your federal tax preparation. Some state tax preparation and filing are free.

There are some free tax prep sites if your AGI is $73,000 or less, you qualify for a free federal tax return. At select tax sites, taxpayers also have an option to prepare their own basic federal and state tax return for free using web-based tax preparation software with an IRS-certified volunteer to help guide you through the process. This option is only available at locations that list “Self-Prep” in the site listing.

Many people prefer to prepare their own taxes rather than paying someone else to do it. Doing your own taxes can save you money and give you a better understanding of your finances. However, it can also be stressful and time-consuming. It is important to make sure that you have all the necessary documents and that you are familiar with the tax laws. If you are unsure about anything, it is always best to consult a professional tax preparer or use a software program like TurboTax for tax assist.

Recommendations on how to reduce your Taxes

Our Professionals are skilled at maximizing your deductions and providing valuable tax savings advice on how to reduce your taxes throughout the year, not just during tax season. Moreover, you will get recommendations for ways to save money on your taxes, including access to tax advice on various tax topics. Hence, it will be very helpful for you to have a full picture of your tax situation.

Upfront transparent pricing

Our tax preparation service offers upfront transparent pricing, ensuring that you receive the best way to understand the costs involved, including tax documents. You will know exactly what to expect from our services before you receive them. There are no hidden fees or costs. In addition, you will never feel like our tax Preparers are misleading you. Moreover, we give straightforward estimates for the services you need, so there are never any surprises when it comes to the final price.

Performance Guarantee

We guarantee you will get your maximum refund! If for some reason, our service cannot beat the other services offered to us on your return, or you are not completely satisfied with the preparation of your returns, you don’t pay anything.

These are just some of the benefits that our service offers for you. We are completely certain that our service will meet and exceed all of your requirements. We promise to provide you with excellent service and will do everything to make you happy.

When it comes to tax preparation, accuracy is key. Many tax preparation services offer an accuracy guarantee to ensure that your taxes are done correctly. These accuracy guarantees give taxpayers peace of mind that their taxes are being prepared properly.

Other important items

When preparing your taxes this year, it is important to have last year’s tax return on hand. This will help you access your Adjusted Gross Income (AGI), which is required for electronic filing. In addition to your AGI, you will need to provide valid Social Security numbers for yourself, your spouse, and any dependents. It’s also important to gather all income and receipts from last year, including any Social Security benefits received. If you had trouble with tax preparation last year, consider using a professional tax service this year.

Tax refund is the amount of money that a taxpayer can receive from the government when they pay more tax than they owe. One way to maximize tax refund is by claiming all eligible tax deductions and credits. Tax preparation services can help taxpayers file their taxes accurately and claim all available tax benefits. Many tax preparation tools are available online that allow taxpayers to easily file their taxes and receive their refund quickly. With the right tax planning and preparation, taxpayers can ensure that they get the maximum tax refund possible. With tax preparation software, we can offer a Maximum Refund Guarantee to our clients. This guarantee ensures that we will calculate the user’s maximum refund based on the information provided, eliminating the need to search for other options.

Direct deposit is a convenient way to receive your tax refund. It allows the IRS to deposit your refund directly into your bank account, which means you don’t have to wait for a check in the mail. To change your direct deposit information, you can refer to the IRS Procedures guidance on how to update your bank account information. With direct deposit, you can also receive your refund faster than if you were to receive a paper check in the mail.

Our Goal

We strive to exceed your expectations and build long-lasting relationships with all of our clients. Nothing makes us happier than knowing we have saved you time and money while providing world-class customer service.

Finally, when it comes to Taxes, providing current services while keeping up with your company’s changing demands in the future.

Bottom Line

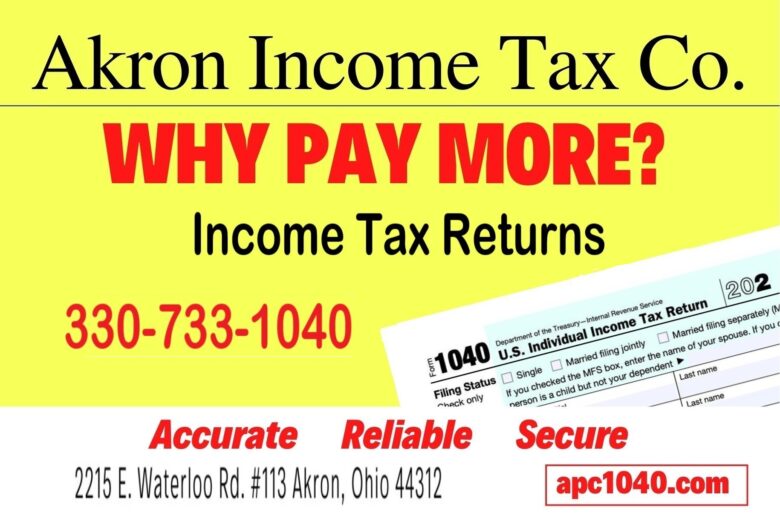

When it comes to your Income Preparation Filing, put your mind at ease by hiring Akron Income Tax Co. Experts. Whether you’re filling out a simple form or creating a proactive strategy to help you minimize your liability. Of course, our professional accountants can give you the timely assistance you require. We are the preferred and trusted choice of individuals and businesses throughout the greater Akron, OH region. We will be happy to put our expertise to work for you!

FAQs

What are some important tips for tax preparation?

Some important tips for tax preparation include gathering all necessary documents, organizing your financial records, staying updated on tax laws and deductions, considering hiring a tax professional and filing your taxes early to avoid any last-minute stress.

How can you make tax preparation less stressful?

To make tax preparation less stressful, start early and stay organized. Keep track of all your financial documents throughout the year and create a system to easily access them during tax season. Consider hiring a professional tax preparer who can guide you through the process and ensure accuracy.

Should you hire a professional for tax preparation or do it yourself?

For tax preparation, it is recommended to hire a professional. They have the expertise and knowledge to navigate complex tax laws, maximize deductions, and minimize errors. While doing it yourself may save money initially, the potential cost of mistakes or missed opportunities can outweigh the benefits.

Why do people go to local tax preparers?

People go to local tax preparers because they offer personalized service, expertise in tax laws and regulations, and convenience. Local tax preparers can ensure accurate tax preparation, help maximize deductions, and provide assistance with any tax-related questions or concerns.

Other Reads